How to safely and effectively outsource tax services

Contents

- How To Safely And Effectively Outsource Tax Services

How To Safely And Effectively Outsource Tax Services

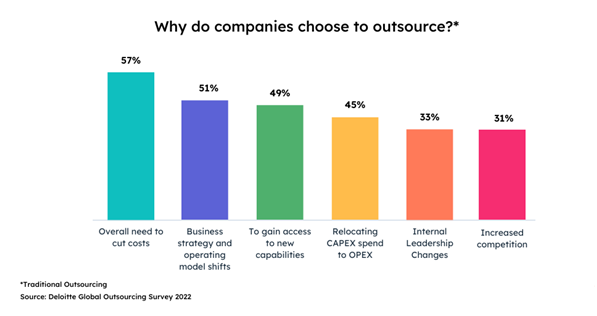

Outsourcing tax preparation offers a strategic advantage for businesses aiming to improve accuracy and efficiency in their financial operations. Tax preparation is a critical function that requires meticulous attention, particularly during extended tax seasons.

Many American firms turn to Indian outsourcing partners due to their proven expertise, cost-effectiveness, and high service standards. The trend toward outsourcing reflects a broader strategy to streamline financial processes and improve overall performance.

Indian firms excel in managing complex tax tasks with precision, helping businesses maintain compliance and achieve better returns on investment. Understanding the key aspects of outsourcing tax services to India can ensure smoother operations, reduced costs, and more reliable financial management.

Why Hire An Outsourced Tax Preparation Partner?

Outsourcing tax return services to an accounting firm offers several benefits –

1. Access to highly experienced and qualified tax professionals

Filing inaccurate tax returns can result in severe penalties and legal issues. Outsourcing gives you access to highly qualified tax experts well-versed in current regulations and industry-specific knowledge. These professionals bring advanced technology and processes, ensuring your financial data is precise and secure. This partnership minimizes risk and saves you from investing in costly technology and expertise yourself.

2. Significant cost savings

Outsourcing tax services can save you 70% to 80% compared to hiring local tax preparers. This helps reduce your upfront costs. Plus, you avoid the expense of training and managing your accounting team by working with skilled tax experts from India.

3. Increase in-house staff productivity

Outsourcing tax preparation can greatly improve your in-house team’s productivity. When you delegate tax tasks to experienced professionals, your staff can concentrate on more important aspects of your business. This move saves both time and money, eliminating the need for expensive accounting software, recruitment, and training. With tax prep handled externally, your team can concentrate on core activities like operations, customer acquisition, and business growth. This enhances efficiency, helps scale your business, and boosts profitability. It eventually allows you to invest more in expanding and improving your company.

4. Streamlined Tax Document Preparation

The days of long, stressful nights spent on tax prep are gone. Now, top CPA firms manage your tax documents, audits, and other related tasks all year. Hiring these experts throughout the year helps you avoid the last-minute rush and reduces the stress of tax season. This way, everything is handled smoothly and efficiently. And it makes the whole process much easier and more manageable.

5. Better organization of the records with Digitization

Traditional paper invoices, receipts, and payroll vouchers are becoming obsolete. Digitization is crucial for smooth accounting and tax preparation to stay ahead. Outsourcing to CPA firms in India ensures that your financial documents are digitized, providing a seamless and organized digital record of all your financial transactions.

6. Scalability and Flexibility

Hiring an outsourced tax preparation partner offers unmatched flexibility and scalability. These services cover everything from accounting and bookkeeping to tax prep, payroll, and cash flow management. You can adjust services to scale up or down based on your business requirements, adapting swiftly to growth or changes.

Outsourcing provides customized solutions that fit your requirements, allowing you to expand your capabilities without the hassle of managing these functions in-house. This means you can stay agile and responsive while ensuring your business remains efficient and adaptable as it evolves.

7. Enhanced Security for Tax Preparation and Filing

Tax preparation outsourcing guarantees top-notch security. Leading firms use advanced infrastructure, licensed accounting software, digital signatures, and encryption to shield your data. These experts ensure your tax processes are secure and reliable. Many top-tier outsourcing companies even integrate with your existing accounting systems, providing an added layer of security. With these robust measures, you can trust that your tax preparation and filing are handled with the utmost confidentiality and care.

How To Outsource Tax Preparation?

Here are some tips for selecting the top tax preparation outsourcing firm for your particular requirements-

Assess Your Tax Preparation Needs

Tax preparation involves various specialized tasks. Start by determining what your company requires. You can choose to hire an expert tax preparer or outsource specific tasks to a top tax preparation firm. Determine which elements of tax prep you want to delegate and select a firm that offers the right services for your needs. This focused approach ensures you get the expertise and support tailored to your business, streamlining your tax process efficiently.

Determine the credibility of the CPA firm

Before partnering with a tax preparation outsourcing firm for outsourced tax services, check their credentials. Go through their track record, portfolio, and certifications. Look for high-profile credentials like ISO and CPA certifications to ensure their legitimacy. This due diligence ensures you choose a reputable firm that meets top industry standards and provides reliable tax preparation services.

Ensure clear communication

When outsourcing tax preparation for the first time, don’t underestimate the power of regular communication. Set up frequent video calls to align both teams on responsibilities and deliverables. Address any issues openly and constructively, avoiding blame. Clear, consistent communication ensures smooth collaboration and helps both parties stay on track. It makes the outsourcing process more effective and efficient.

Understand the various tax preparation models

CPA firms offer various models to help you maximize ROI from outsourcing tax services to India. Learn about the different options to find what best fits your needs. Choices include hiring a seasonal tax preparer for full-time, part-time, or set hours. Other options include offshore tax prep with return services and specialized tax audit and reconciliation. Each model provides unique benefits, so select the one that aligns with your business requirements and goals.

Evaluate Costs and Budget

High-quality tax preparation services are costly, but they must fit your budget. The outsourcing company should offer rates lower than your in-house expenses to ensure a strong return on investment. Outsourcing can reduce costs, but you must compare value to ensure you get the best deal. Assess various options to balance cost with quality and maximize your ROI. Ensure the investment matches with your financial goals for optimal results.

Ensure Data Security and Compliance

When outsourcing tax services, ensuring data security is a top priority. Review your internal systems and processes to guarantee secure data transmission. Typically, this involves the external partner accessing client servers with secure logins.

Confirm the external partner’s GDPR and data security credentials. Understand their procedures for safeguarding data and conduct a thorough risk assessment. Update your internal policies to reflect the new outsourcing tasks and data handling. Decide if the external partner needs full access to client data or just limited, anonymous information.

Start with a Trial Project

You can initiate a partnership if the CPA firm meets your experience, reliability, and budget criteria. Before committing, start with a small accounting project to evaluate their performance.

Conclusion

Outsourcing tax services can streamline your operations and alleviate the tax season burden on your team. It will help scale your company towards success. As tax and staffing challenges intensify, outsourcing offers a viable path for growth and efficiency. However, while outsourcing can lighten the load, it also demands diligent management. Your firm must oversee processes and workflows to ensure smooth operations. Most importantly, all outsourcing activities should be conducted within a secure cloud environment to protect data and maintain operational continuity. By carefully managing these aspects, you can optimize the benefits of outsourcing while safeguarding your firm’s interests.

Frequently Asked Questions

Q1: What are the benefits of outsourcing tax preparation?

Outsourcing tax preparation saves valuable time, enhances accuracy, and reduces errors. It enables businesses and individuals to concentrate on their core activities while leveraging the experience and expertise of the individuals. It often results in significant cost savings.

Q2: How do tax outsourcing services operate?

Tax outsourcing involves enlisting specialists to handle tax-related tasks. They gather and review financial documents, analyze data, optimize returns, and ensure accurate filing. It simplifies the entire tax process for businesses and individuals.

Q3: Is outsourcing tax preparation cost-effective?

Yes, outsourcing can be cost-effective. Though there are fees, the expertise provided often results in higher refunds and fewer mistakes. This eventually reduces the risk of penalties and offers a solid financial advantage.

Q4: Can outsourcing increase tax deductions and credits?

Yes! Experienced tax professionals in outsourcing services meticulously examine your financial data to ensure all eligible deductions and credits are claimed. This leads to higher refunds or reduced tax liabilities.

Q5: What do tax professionals do in outsourcing?

Tax professionals in outsourcing are experts in tax law who provide tailored guidance, manage complex tax situations, ensure compliance with regulations, and minimize risks.

Q6: How secure is outsourced tax preparation?

Reputable tax outsourcing providers prioritize data security using encryption, secure file transfer methods, and strict protocols. Choosing a trusted provider ensures your data remains confidential and protected against breaches.

Q7: Can individuals benefit from outsourced tax services?

Definitely! Outsourced tax services are beneficial for individuals, including freelancers and retirees. These services ensure accurate tax filings and optimization. You can also reap the benefits of expert assistance tailored to individual needs.

Q8: What risks are associated with tax outsourcing?

Risks, though rare, include potential data breaches or errors. However, selecting a highly reputable outsourcing provider with robust security measures and positive reviews can significantly mitigate these risks.