The Shift to Cloud-Based Bookkeeping: Why More Businesses Are Outsourcing

Contents

- The Shift to Cloud-Based Bookkeeping: Why More Businesses Are Outsourcing

The Shift to Cloud-Based Bookkeeping: Why More Businesses Are Outsourcing

As technology advances and businesses seek greater efficiency, outsourcing accounting services is rising. Innovative business models stand out in a competitive startup environment, where small businesses compete for market share. Bookkeeping plays a crucial role in this success. Cloud-based accounting software offers a streamlined, organized solution to the traditionally tedious bookkeeping process.

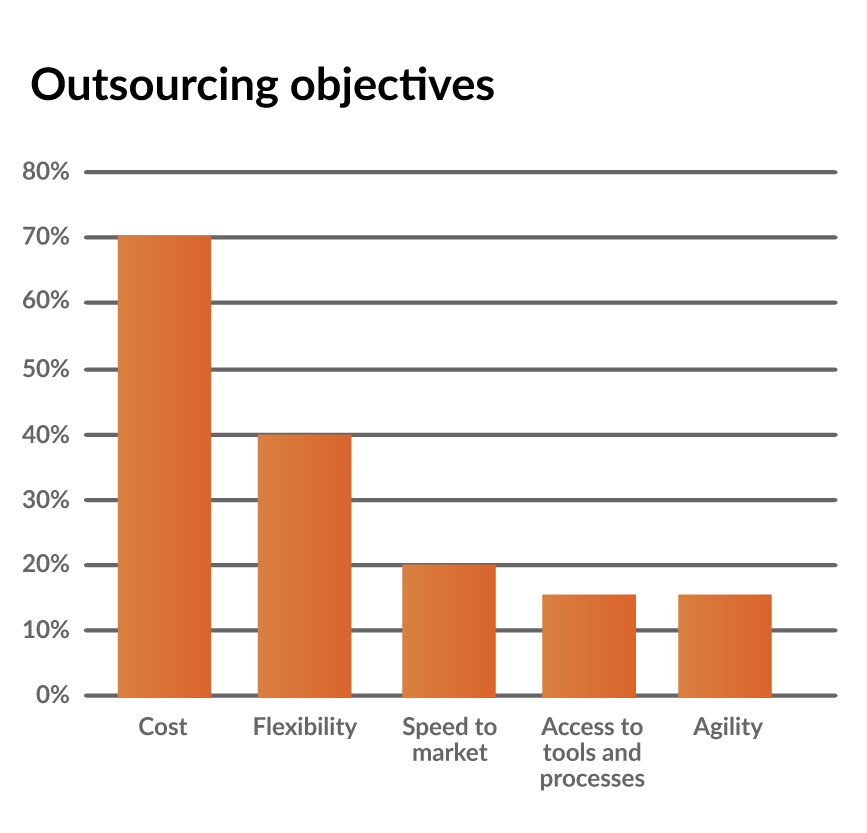

While the conventional approach has been to maintain internal accounting teams, outsourcing is gaining popularity for several reasons. This shift is driven by the need for efficiency, cost-effectiveness, and the flexibility that outsourcing provides. As a result, outsourcing has become an ideal option for businesses aiming to optimize their financial management.

Significance of Bookkeeping for Businesses

Bookkeeping is essential for businesses of all sizes, from small startups to large enterprises. It involves systematically recording and maintaining detailed financial records, crucial for tracking a company’s financial health.

With technological advancements, many businesses are now choosing to outsource bookkeeping, as it aligns with modern business practices. Outsourcing bookkeeping offers efficiency and flexibility, making it a prudent choice for businesses aiming to stay competitive in today’s digital landscape. In the modern business world, bookkeeping is important for many reasons, including the following:

- Accurate Financial Management: Bookkeeping is crucial for modern businesses because it ensures accurate financial management. Bookkeeping guarantees that all expenditures are correctly recorded, as it helps track every transaction. This not only aids in monitoring cash flow but also offers valuable insights into spending patterns. Proper record-keeping is essential for making informed financial decisions, such as investments or budget allocation.

- Regulatory Compliance: Navigating ever-changing financial regulations while managing daily operations can be challenging. Proper bookkeeping helps by maintaining organized records that prove your business has met financial obligations like taxes and payroll.

- Strategic Growth Planning: Accurate financial reports are key to strategic planning. They help identify areas for cost reduction and highlight potential revenue opportunities for the business.

- Employee Performance Assessment: Bookkeeping allows managers to evaluate employee performance through detailed records of tasks assigned and completed. This enables early improvements rather than waiting until year-end reviews.

Benefits of Outsourcing Bookkeeping for Modern Businesses

Outsourcing bookkeeping is becoming increasingly popular in modern business practices. It involves hiring a third-party company or individual to handle various financial tasks for a business. These tasks include maintaining financial records, preparing tax documents, and managing accounts payable and receivable.

Outsourcing bookkeeping is becoming increasingly popular in modern business practices. It involves hiring a third-party company or individual to handle various financial tasks for a business. These tasks include maintaining financial records, preparing tax documents, and managing accounts payable and receivable.

This approach allows businesses to focus on their core activities while leaving the complex and time-consuming financial work to professionals. More and more businesses prefer to outsource their bookkeeping requirements and shift to cloud-based systems for the following reasons.

- Improved Accuracy and Efficiency

One of the major advantages of outsourcing bookkeeping is the improved accuracy and efficiency it brings. Professional bookkeepers have the expertise and knowledge to manage financial records accurately and efficiently. They are skilled in using advanced accounting software that streamlines processes and minimizes the risk of manual errors. By outsourcing these tasks to experts, businesses can ensure that their financial records are accurate and compliant with relevant regulations.

- Scalability

Outsourcing bookkeeping also offers greater scalability for businesses. As a company grows or faces a fluctuating workload, managing all financial tasks internally can become challenging without causing delays or mistakes. Outsourcing allows businesses to scale their bookkeeping services up or down as needed easily. Moreover, it eliminates the burden of hiring and training new employees or overwhelming existing staff.

- Cost Savings

One of the major benefits of outsourcing bookkeeping is the significant cost savings it offers. Businesses can avoid the expenses associated with hiring full-time employees by outsourcing. They can save significant money on salaries, benefits, and training costs. There’s also no need to invest in expensive accounting software and technology, as the outsourcing firm provides these tools. Additionally, by entrusting their finances to professionals, businesses can reduce the risk of errors that could lead to costly financial mistakes.

- Access to Specialized Expertise

A significant benefit of outsourcing is access to specialized expertise that may not be available in-house. Bookkeeping service providers often have teams of trained professionals with diverse backgrounds. The experts can offer customized solutions to optimize financial processes for specific industries or businesses. This specialized knowledge can be invaluable in helping businesses streamline their financial operations and make informed decisions.

- More Time for Core Business Activities

Outsourcing bookkeeping frees up valuable time for business owners and managers, allowing them to focus on other critical aspects of running their company. They can dedicate more time to strategic decision-making and other business functions that drive growth and success. This can lead to increased productivity, improved efficiency, and higher profitability for the business.

- Aligning with Modern Business Trends

Outsourcing bookkeeping is a cost-effective solution. It allows companies to manage their financial tasks efficiently while focusing on their core competencies. With benefits such as cost savings, enhanced accuracy and efficiency, scalability, access to specialized expertise, and more time for strategic planning, it’s no surprise that outsourcing bookkeeping remains a popular choice for businesses of all sizes.

Debunking Common Myths About Outsourcing Bookkeeping

Outsourcing bookkeeping is becoming a popular choice for businesses of all sizes, but several myths still create uncertainty for some business owners. Let’s clarify these misconceptions and highlight the benefits of outsourcing bookkeeping.

Myth 1- Outsourcing is Only for Large Corporations

A common belief is that outsourcing bookkeeping is only beneficial for large companies with substantial financial resources. This isn’t true. In fact, outsourcing can be highly advantageous for small businesses as well. It provides access to professional accounting services at a lower cost compared to hiring an in-house bookkeeper or accountant. For small businesses outsourcing helps save money. It allows more funds to be invested in other critical areas of the business while remaining competitive.

Myth 2- Maintaining Control over Financial Information is Difficult

Some business owners worry about losing control over their financial information when they outsource bookkeeping. However, reputable outsourcing firms have strict confidentiality policies to protect client data. They also offer real-time updates and reports, so business owners can monitor their finances anytime. This level of transparency helps maintain control and ensures that financial information remains secure.

Myth 3- Communication Barriers are a Major Issue

Another misconception is that communication barriers may arise due to language or cultural differences between the outsourcing provider and the client. Most outsourcing companies are equipped with dedicated teams skilled in clear and effective communication. Advances in technology make it easy to stay connected, regardless of geographical location. This means that concerns can be addressed promptly and communication remains smooth.

Myth 4- Outsourcing is Less Reliable Than an In-House Team

Some believe that outsourcing bookkeeping is less reliable than having an in-house team. On the contrary, outsourced bookkeepers are often highly skilled professionals specializing in accounting and finance. They use the latest technologies and follow best practices to ensure accuracy and efficiency. In-house teams might juggle multiple roles, which can affect their focus on bookkeeping tasks.

Conclusion

As technology advances rapidly, so do business practices. Outsourcing bookkeeping services, particularly through cloud-based solutions, is increasingly popular among companies aiming to streamline operations and focus on their core activities. The key benefits of cloud-based outsourcing include significant cost savings, access to specialized expertise, improved efficiency, and the ability to scale operations easily.

Bookkeeping remains crucial for businesses due to its role in accurate financial management, ensuring legal compliance, and supporting strategic planning and performance evaluation. With the shift to cloud-based bookkeeping and evolving business trends, outsourcing these services is a smart choice for companies looking forward to staying competitive.

Frequently Asked Questions

- What is bookkeeping outsourcing?

- Bookkeeping outsourcing involves hiring an external service provider to manage your business’s financial record-keeping tasks. This can include recording transactions, managing accounts payable and receivable, reconciling bank statements, and preparing financial reports.

- What are the benefits of outsourcing bookkeeping?

- Outsourcing bookkeeping can offer several advantages, such as cost savings, access to expert knowledge, improved accuracy, enhanced efficiency, and the ability to focus on core business activities. It also provides scalability, allowing services to grow with your business needs.

- How do I choose the right bookkeeping outsourcing provider?

- When selecting a provider, consider factors like their experience and expertise in your industry, reputation and client testimonials, range of services offered, pricing structure, data security measures, and their ability to communicate effectively and integrate with your existing systems.

- Is my financial data secure when outsourcing bookkeeping?

- Reputable bookkeeping outsourcing firms prioritize data security and implement robust measures to protect your information. This typically includes encryption, secure data storage, strict access controls, and confidentiality agreements. Always verify the security protocols of any provider you consider.

- How much can I expect to save by outsourcing bookkeeping?

- Savings vary depending on factors such as the size of your business, the complexity of your bookkeeping needs, and the pricing structure of the outsourcing provider. Generally, outsourcing can reduce costs related to hiring in-house staff, training, software, and benefits, often resulting in significant overall savings.

- Can I outsource specific bookkeeping tasks or do I need to outsource everything?

- Yes, many bookkeeping outsourcing services offer flexibility, allowing you to outsource specific tasks such as payroll processing, tax preparation, invoicing, or financial reporting. This enables you to tailor the services to meet your particular business needs without committing to full-service outsourcing.